Incentives That

Drive You Further

Make Your Move to Electric Easier.

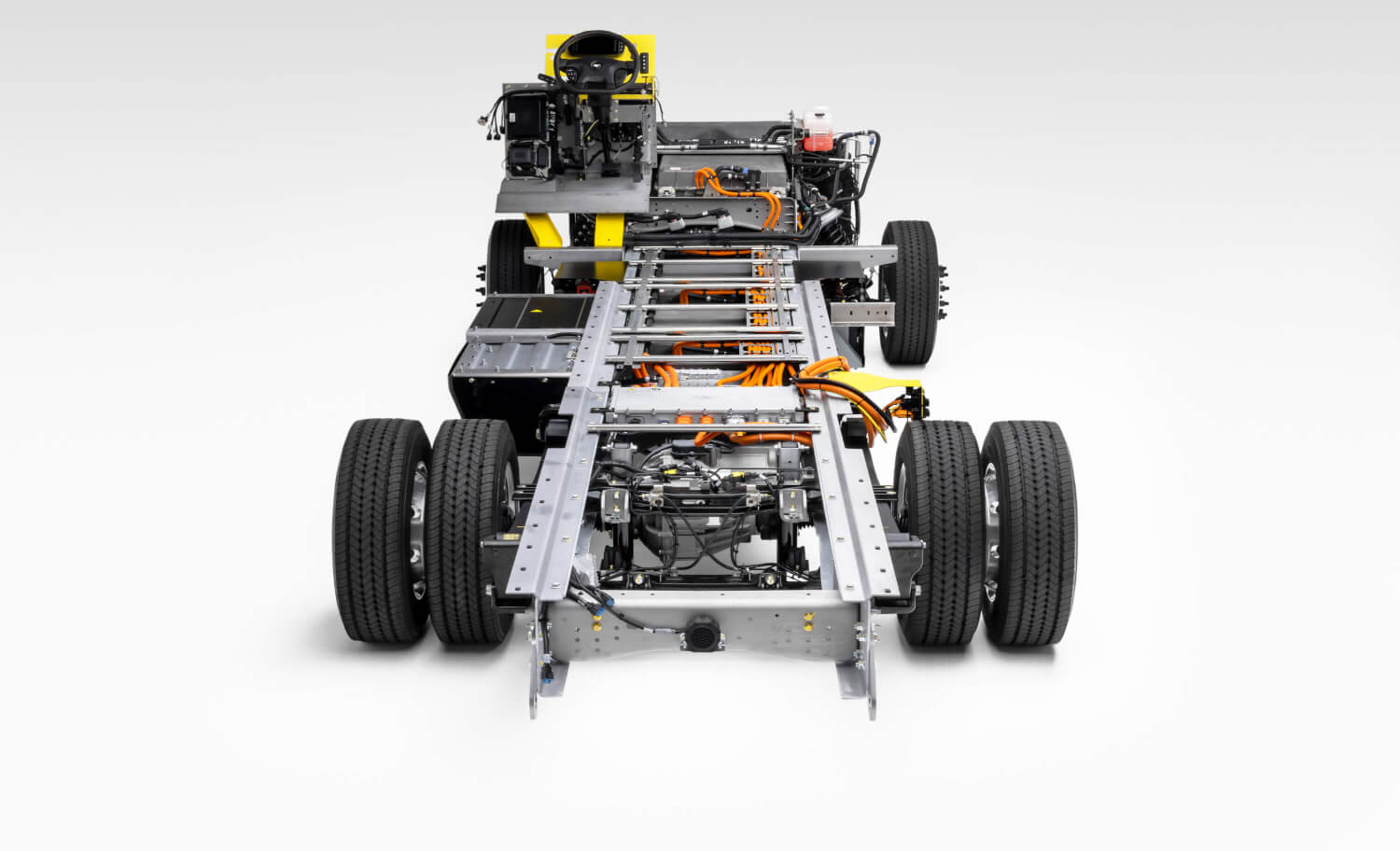

From significant federal tax credits to state-level grants and regional rebate programs, Harbinger customers can take advantage of a wide range of incentives that reduce upfront costs and improve ROI.

Whether you're purchasing a single chassis or planning a full fleet conversion, we'll help you navigate the opportunities available to you.

Incentives by Location.

Max Reimbursement per Vehicle: Up to $40,000

Class Application: Commercial medium-duty EVs

Additional Details: Applies to Harbinger chassis; stackable with local/state incentives

Requirements: Vehicle must be delivered by 9/30/25

Max Reimbursement per Vehicle: Up to $1,220,000 (total equipment deduction)

Class Application: Qualifying commercial EVs

Additional Details: Deduct vehicle purchase cost from gross income

Requirements: Vehicle must be placed in service during the tax year

Max Reimbursement per Vehicle: Varies by state and program

Class Application: All vehicle classes

Additional Details: Comprehensive database of federal and state incentives, laws, and programs for alt-fuel and EV fleets

Requirements: Programs vary in availability and scope. Includes grants, tax credits, rebates, and infrastructure support